Did You File Before Congress Passed the Unemployment Tax Exclusion? Here is How the IRS is Handling the Situation

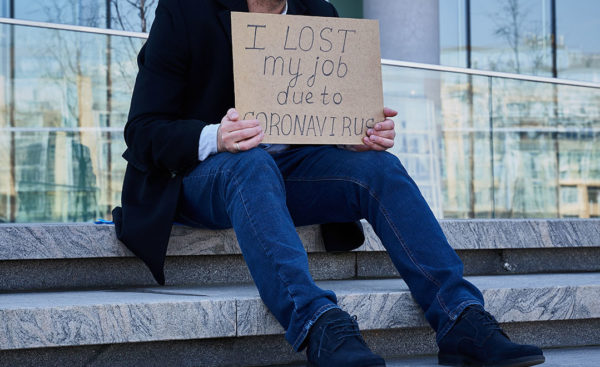

Did you pay taxes on your unemployment benefits you received during the pandemic? Normally, unemployment insurance benefits are fully taxable for federal purposes. As part of the American Rescue Plan Act, Congress decided that each individual who received unemployment benefits could exclude the first $10,200 of those benefits from taxation if their modified AGI was less than $150,000. The IRS will be adjusting your tax return.