It may seem like a no-brainer—cut expenses to make more money—but many small changes can result in significant savings.

It looks like the economy may finally be looking up. Still, this is no time to loosen the purse strings in terms of your business expenses. Rather, why not re-double your efforts to cut costs and boost your profitability? Excessive expenses cause debt, which in itself can be very costly. So any money-saving actions you take will be doubly rewarding.

More Effective Money Management

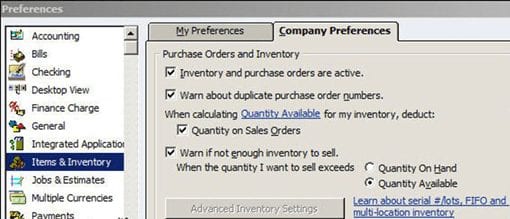

To cut expenses significantly, poke into every corner of your company’s finances. Inventory is a good place to start. If you sell multiple units of the same item and reorder regularly, you should be using QuickBooks’ inventory-tracking tools. Go to Edit | Preferences | Items & Inventory | Company Preferences.

Figure 1: Make sure that these settings are correct. If you need advanced features like FIFO costing, serial number and lot-tracking or inventory management at multiple locations, contact us about upgrading to Enterprise Solutions.

You should be stocking your inventory to match the pace of sales. You don’t want to be caught short, nor do you want to be sitting on too much and tying up money unnecessarily. QuickBooks can help, but you’ll need to calculate the sweet spot for each item. Several built-in reports can help, including:

- Inventory Valuation Summary: Displays the current asset and retail value of each item and inventory as a whole

- Inventory Valuation Detail: Shows how individual transactions have affected the value of your inventory

- Inventory Stock Status By Item: Helps you set up smart reordering procedures

- Open Purchase Orders: Outlines each purchase order and its expected delivery date

To maintain profitable inventory levels and minimize expenses, you’ll need to study QuickBooks’ related reports regularly. When you’re making buying decisions, consider factors like reorder turnaround time and seasonal sales upticks.

Using Available Tools

The efforts you make toward reducing expenses in other ways can result in more savings than you might think. Here are some actions you can take that will accelerate your cash flow:

Use QuickBooks’ budgeting tools. This doesn’t need to be as onerous as you might expect – you can start by pulling in your real data from the previous year as a base. Build in line items for ongoing accounting support like QuickBooks maintenance. Click on Company | Planning & Budgeting | Set Up Budgets.

For assistance, contact one of Henssler Financial’s Certified QuickBooks ProAdvisors®: 770-429-9166 or experts@henssler.com.