A decade ago, the Stephen Beck Jr., Achieving a Better Life Experience (ABLE) Act was signed into law. The idea for it originated with a group of parents in Virginia who saw that individuals with disabilities and their families needed a way to save for the future without sacrificing eligibility for much-needed federal benefits. One of those parents was Beck, a congressman who had a daughter with Down syndrome. It took years for a bipartisan group in Congress, supported by many advocates, to develop the bill that was finally passed in December 2014.1

Ten years later, 46 states and the District of Columbia offer ABLE accounts.2 These tax-advantaged accounts enable Americans with significant disabilities that began before age 26 to save or invest funds that can be used for qualified disability expenses. In honor of ABLE’s tenth anniversary, here are a few key facts about ABLE accounts.

Most state programs are open to nonresidents. Individuals can open an ABLE account in their own state if it has an ABLE program or in any state that allows nonresidents to join (most do).

Accounts offer several tax benefits. Any earnings on contributions accumulate tax deferred at the federal level (and in some cases at the state level). When money is withdrawn, the earnings on these distributions will be tax-free if used to pay qualified expenses. Though no federal income tax deduction is available, some states offer tax incentives to residents, such as a deduction for contributions. Before investing in an ABLE plan, consider whether your state offers an ABLE plan that provides residents with favorable state tax benefits. Consult a tax professional for more information. ABLE accounts may be protected from creditors if you invest in your own state’s program, depending on the state.

Having an account generally does not affect eligibility for public benefits. People with disabilities often rely on Supplemental Security Income (SSI), Medicaid, Medicare, and other public benefits. However, eligibility for these benefits depends on meeting a means or resource test. To qualify, individuals can have only $2,000 in countable assets, such as savings and retirement funds. Because funds in an ABLE account generally do not count toward this asset limit, people may put money aside for their future needs without jeopardizing their eligibility for public benefits. (SSI benefits may be temporarily affected once an account reaches $100,000.)

Contributions can be made by the account owner or others. Multiple people may contribute, including the individual with the disability, family members, friends, and employers. Contributions may also come from sources such as special needs trusts, estates, or 529 plan rollovers. Annual and lifetime contribution limits apply. Contributions from all donors combined during the year can’t exceed the annual gift tax exclusion, which is $18,000 in 2024. ABLE account owners who work and who don’t have an employer-sponsored retirement account, may save an additional $14,580 from their earnings in 2024 ($16,770 in Hawaii and $18,210 in Alaska). Each state sets its own lifetime limit.

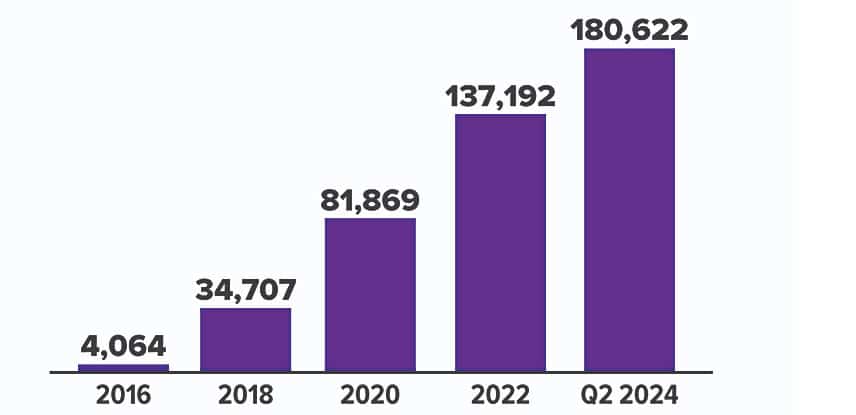

Growing Number of ABLE Accounts

Source: ABLE today, 2024

Funds can be spent on a wide range of items. The definition of qualified disability expenses is broad and generally includes housing costs, home improvement and modification, transportation, health care, education, employment training, assistive technology, and personal assistance, among others.

The eligibility age is changing. Today, to be eligible for an ABLE account, the disability must have begun before age 26, but starting in 2026, this age will increase to 46, giving access to an estimated six million more Americans, including one million veterans.3

Other planning tools may also be used. An ABLE account is meant to be an additional tool — not the only tool — that can be used to save for future expenses. Other tools, which include third-party and special needs trusts, have unique benefits and drawbacks, and may also be suitable. (The use of trusts involves a complex web of tax rules and regulations and incur up-front costs and often have ongoing administration fees.)

Participating in an ABLE account may involve investment risk, including the possible loss of principal, and there can be no assurance that any investing strategy will be successful. Carefully consider a portfolio’s level of risk, charges, and expenses before investing. The program’s official disclosure statement and applicable prospectuses, contain this and other information about the investment options, underlying investments, and the investment company.

If you have questions, contact the Experts at Henssler Financial:

- Experts Request Form

- Email: experts@henssler.com

- Phone: 770-429-9166