QuickBooks handles billable expenses capably, but it’s critical that you understand the process thoroughly before proceeding.

Billing for inventory parts is easy. Pick the items from a list and specify a quantity. Poof. Done.

Billing for costs, time or mileage is a little more complex. QuickBooks has built-in tools to help you do this, but it’s a bit of a process.

To simplify your workflow, do this groundwork first:

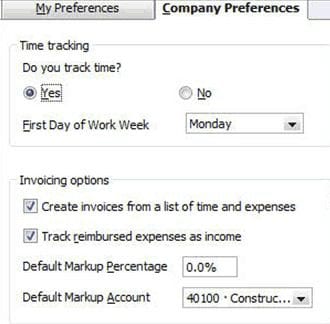

- Go to Edit | Preferences | Time & Expenses | Company Preferences.

- Click the Yes button under Time tracking and indicate your choices under Invoicing options.

- If you plan to mark up some costs and want a default number, enter a percentage and account (these can be changed on individual invoices).

Figure 1: As you do with other QuickBooks processes, make sure that your Preferences are set correctly.

- Add any billing items necessary by clicking Lists | Item List and then Item | New in the lower left corner.

- If you plan to bill for mileage, go to Lists | Customer & Vendor Profile List | Vehicle List and enter information about every business vehicle.

Invoicing for Services

If you’re a service-oriented company, you bill for time frequently. This is easy. You’re probably already familiar with the Enter Time entry in the Employees menu. Whether you make individual time entries or complete a timesheet, it’s critical that you make the correct selections for each Customer: Job, Service Item and Payroll Item field, and check the Billable box.

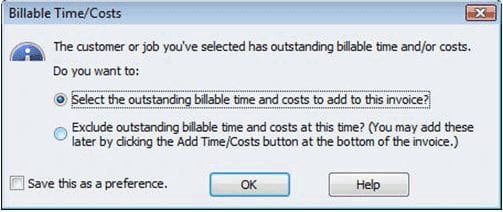

When you create invoices, this box will open after you select a customer:

Figure 2: QuickBooks lets you know when there are time and costs to be billed for each customer.

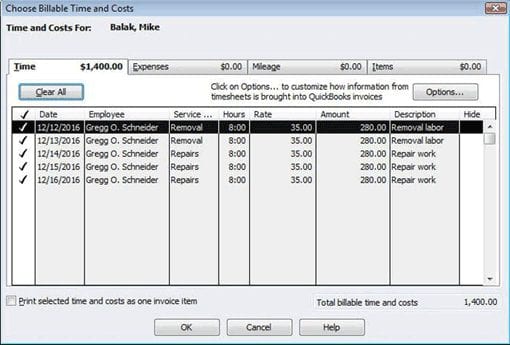

You can let QuickBooks enter the time totals now, or add them later by clicking the Add Time/Costs button. Either way, the Choose Billable Time and Costs window opens. Add a checkmark next to each entry that should be billed, and click Options… to indicate whether you want one line for each time entry or would rather combine all similar service item types.

Figure 3: QuickBooks wants to know which entries should be invoiced.

More Complexity

If you’re done with billable expenses for this invoice, click OK. If there are other costs that you covered, click the Expenses tab to see all transactions that you earmarked for this client on a bill, check or credit card. You have the option here to mark up the cost by a percentage or amount (even if you established this in Preferences), and to specify an account.

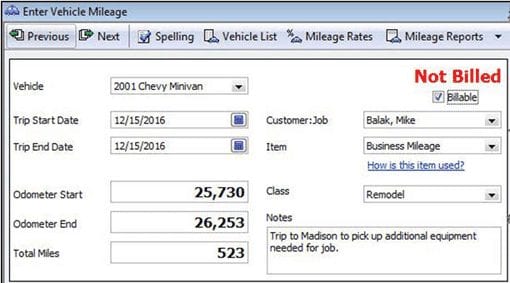

Do the same for Mileage, which you would have entered previously—when it was incurred—at Company | Enter Vehicle Mileage. Then select any Items that you purchased for the customer. Your records should be correct—assuming that you were conscientious about assigning expenses to customers and jobs.

Figure 4: It’s easy to pull billable expenses into invoices if they’re documented carefully.

Turning expenses into invoices and then into income can be complicated. If you need assistance, contact one of Henssler Financial’s Certified QuickBooks ProAdvisors®: experts@henssler.com or 770-429-9166.