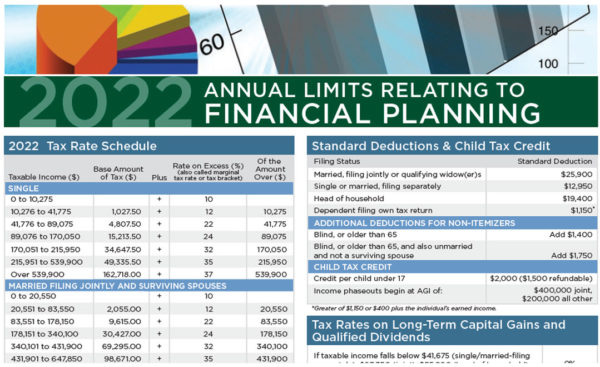

In the News: The IRS is Accepting Returns, but Make Sure You Have all Your Forms

As seen in the Marietta Daily Journal: Bil Lako, CFP®, warns that while the IRS is accepting returns, you need to be sure you have all your forms and letters before you file. Read the article at the Marietta Daily Journal. This article is for demonstrative and academic purposes and is meant to provide valuable background…