Infographic: Where Inflation Has Hit the Hardest, 2000-2025

Affordability for key essentials remains a sticky issue in the United States. This graphic shows the cumulative rate of inflation across key goods and services in the U.S. between 2000 and September 2025. Items with the highest inflation Hospital services have consistently outpaced inflation over the past several decades, with costs rising a stunning 275% […]

No More Groundhog Day for Your Finances: Time for a Financial Wellness Checkup

Groundhog Day isn’t just a movie—it can describe our money habits, too. A financial wellness checkup can help you spot patterns, reset priorities, and make meaningful changes while there’s still time this year.

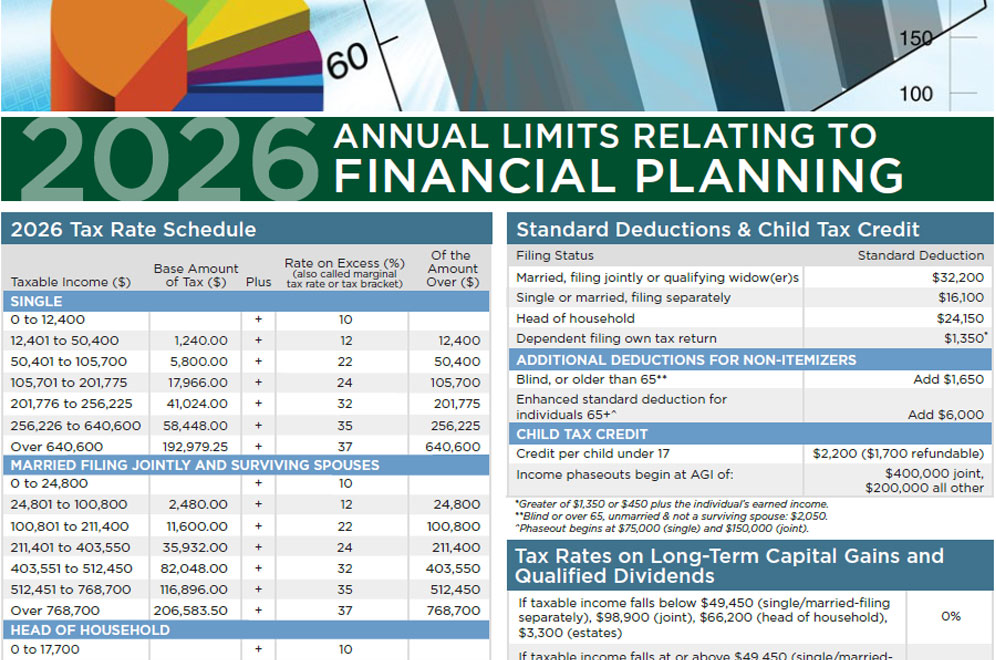

2026 Annual Limits Relating to Financial Planning

Stay ahead in 2026 with our Annual Financial Planning Limits Guide—your go-to reference for the key numbers that shape smart financial decisions throughout the year.

ABLE Accounts Are Now Available to Millions More with Disabilities

As of January 1, 2026, ABLE account eligibility has widened—now including individuals whose disability began before age 46. That change could open the door for millions more Americans, including many veterans, to save and invest for the future without jeopardizing critical public benefits.

Holiday Tipping Etiquette: ‘Tis the Season to Show Your Appreciation

Holiday tipping can feel awkward—but it doesn’t have to be. From who to tip, to how much to give, a little planning can help you show appreciation without overdoing it. Read our practical guidelines to help you navigate holiday tipping with confidence and gratitude.

Online Shopping in the Tariff Era

Surprised by new shipping duty charges? You’re not alone. The U.S. has eliminated the de minimis exemption for most low-value imports, meaning more overseas purchases now come with tariffs, carrier fees, and delivery delays. Before you click “buy,” make sure you understand the new rules.

IRS Shifts to Paperless Refunds: What This Might Mean for You

Paper refund checks are officially on the way out! Starting September 2025, most taxpayers will receive refunds electronically—a faster, safer way to get your money. But what if you don’t have a bank account?

Understanding the Taxation of Lawsuit Settlements: What Taxpayers Need to Know

Receiving a lawsuit settlement? Don’t let taxes take you by surprise. Understanding which parts of your settlement are taxable—and how attorney fees affect your net proceeds—can make a huge difference in your financial planning.

Beneficiary Designations: Who Gets the Money?

As families gather for the holidays, take a moment to think about the future. Are your beneficiary designations up to date? Life changes fast—make sure your will, insurance, and accounts still reflect your wishes.

Mandatory Roth Catch-Up Contributions Begin in 2026

Attention savers 50+! The SECURE 2.0 Act just made “catch-up contributions” even bigger—especially if you’re 60–63. But starting in 2026, some high earners will have to make these contributions on a Roth basis.