Contributing to both an Individual 401(k) and a 401(k)

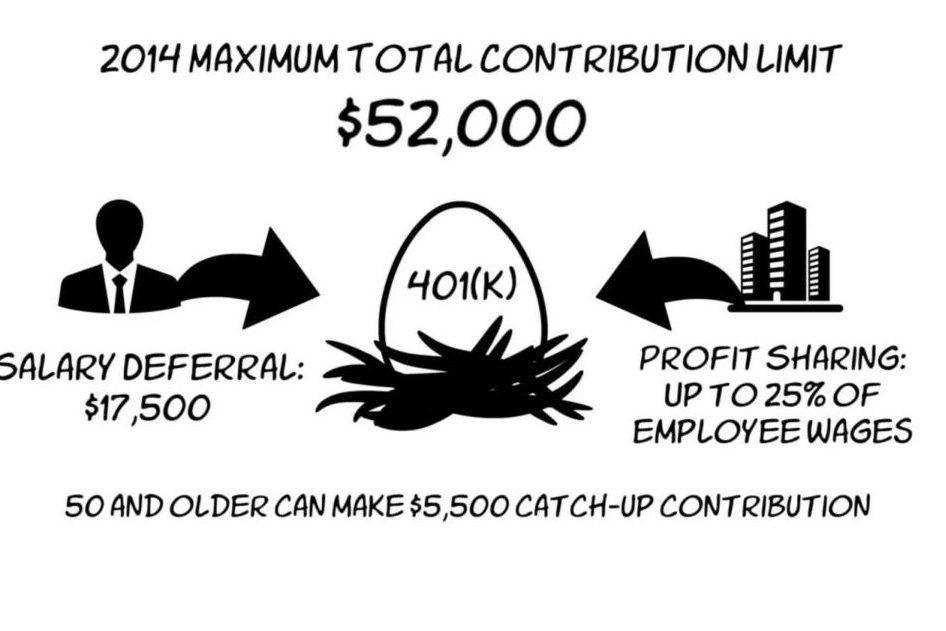

The hosts of “Money Talks,” Bil Lako, CFP®, and Troy Harmon, CFA, and Matt Hames, CTFA, discuss the overall 401(k) contribution limits. They describe the contributions limits for both salary deferral and profit-sharing contributions, and the best way to maximize your investment.