Beginning in 2015, large employers, generally those with 50 full-time employees in the prior calendar year, that:

- Do not offer coverage for all their full-time employees;

- Offer minimum essential coverage that is unaffordable (employee contribution being more than 9.5% of the employee’s household income), or

- Offer minimum essential coverage where the plan’s share of the total allowed cost of benefits is less than 60% (i.e. less than the bronze coverage),

will be required to pay a penalty if any of its full-time employees were certified to the employer as having purchased health insurance through a state or federal exchange and qualified for either tax credits or a cost-sharing subsidy previously discussed.

Implementation Delayed

This provision of the new health care legislation was meant to have taken effect by 2014. Intense lobbying from the business community, however, which cited lack of time to prepare for the new requirement, has prompted the Obama Administration to delay implementation by one year, to 2015.

Interaction with Premium Credit

Generally, if an employee is offered affordable minimum essential coverage under an employer-sponsored plan, he is ineligible for a premium tax credit and for cost-sharing reductions for health insurance purchased through a state or federal exchange.

If the coverage is unaffordable (see above), however, or the plan’s share of benefits is less than 60%, then he is eligible, but only if he declines to enroll in the coverage and purchases coverage through the exchange instead.

Penalty for Employer Not Offering a Health Care Plan:

An applicable large employer would be liable for the penalty (figured monthly) if:

- The employer has failed to offer to its full-time employees (and their dependents) the opportunity to enroll for that month in “minimum essential coverage” under an “eligible employer-sponsored plan”; and

- At least one full-time employee has been certified to the employer as having enrolled for that month in a qualified health plan for which a premium tax credit or cost-sharing reduction is allowed or paid with respect to the employee.

The excise tax penalty for any month would be $167 ($2,000/12) times the number of full-time employees in excess of 30.

Example—No Health Care Plan. In January of 2015, an applicable large employer with 120 employees does not offer a health care plan to its employees. The penalty is $167 times the number of full-time employees in excess of 30. Thus, the penalty for the month of January is $15,030 ((120-30) x $167.00).

Penalty – Employees Qualify for Premium Tax Credits or Cost-Sharing Assistance

An applicable large employer would be liable for the penalty (figured monthly) if:

- The employer offers to its full-time employees (and their dependents) the opportunity to enroll for that month in “minimum essential coverage” under an “eligible employer-sponsored plan”; and

- At least one full-time employee has been certified to the employer as having enrolled for that month in a qualified health plan for which a premium tax credit or cost-sharing reduction is allowed or paid with respect to the employee.

The excise tax penalty for any month would be $250 ($3,000/12) times the number of full-time employees that received premium tax credit or cost-sharing reductions through an exchange, but would not exceed the penalty imposed had the employer not offered health care insurance.

Example—Health Care Plan, but with Employees Qualifying for Premium Tax Credit or Cost Sharing Reductions. In January of 2015, an applicable large employer with 120 employees offers its employees a health care plan, but the plan’s cost does not meet the affordable criteria—that employee contribution be more than 9.5% of the employee’s household income, or that the plan’s share of the total allowed cost of benefits be less than 60%—and 20 of the employees sign up for the insurance through an exchange and receive premium tax credit or cost-sharing reductions. The employer’s excise tax penalty is $250 times 20. Thus, the penalty for the month of January is $5,000.

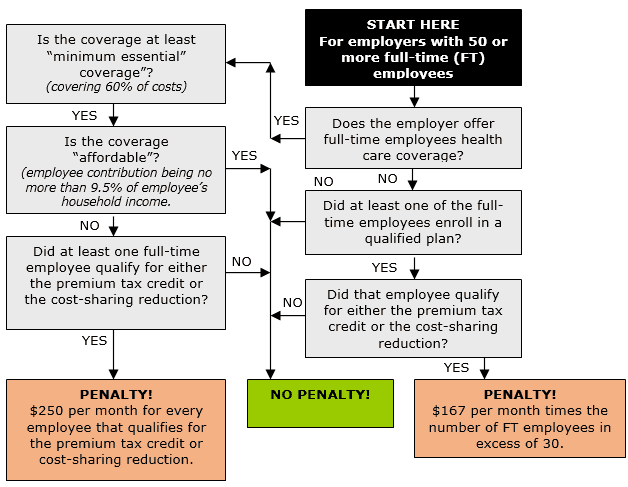

Large Employer Health Coverage Excise Tax Decision Tree

The flow chart below provides an overview of the large employer health care excise tax.

Applicable Large Employer

An “applicable large employer” is one that employed an average of at least 50 full-time employees on business days during the preceding calendar year (for an employer that was not in existence throughout the preceding calendar year, the determination is based on the average number of employees reasonably expected to be employed on business days in the current calendar year).

Seasonal Workers

But, under an exemption, an employer will not be considered to employ more than 50 full-time employees if: (a) the employer’s workforce exceeds 50 full-time employees for 120 days or fewer during the calendar year; and (b) the employees in excess of 50 employed during that 120-day (or fewer) period are seasonal workers, e.g., retail workers employed exclusively during the holiday season. Special rules apply to construction industry employers.

Full-time-employee

For purpose of complying with the 50 full-time-employee requirement, count those working 30 hours or more per week.

Part-Time Employees

Solely for determining whether an employer is an applicable large employer, an employer will also have to include for that month the number of full-time employees determined by dividing (a) the aggregate number of hours of service of employees who are not full-time employees for the month by (b) 120.

Example—Equivalent Full-Time Employees: John has, for his business, 45 full-time employees plus 20 part-time employees. His part-time employees for the month of January have worked 960 hours. This is equivalent to 8 (960/120) full-time employees. Thus, the number of John’s full-time employees for the month of January is 53 (45 + 8).

Penalty Deductibility

This excise tax penalty is nondeductible under the general rules for excise taxes.

If you have questions or need assistance, contact the Experts at Henssler Financial: experts@henssler.com or 770-429-9166.