A private family foundation is a legal entity created, funded, and operated by a single family for the primary purpose of making grants to charities. Because of its charitable mission, a private family foundation is given tax-exempt status, like a public charity, and contributions to the foundation by family members are tax deductible, but to a lesser extent than contributions to a public charity.

Typically, private family foundations are named to honor the founders (e.g., the Ford Foundation), and their charitable grant programs continue for many years after their founders’ deaths.

What is a private family foundation?

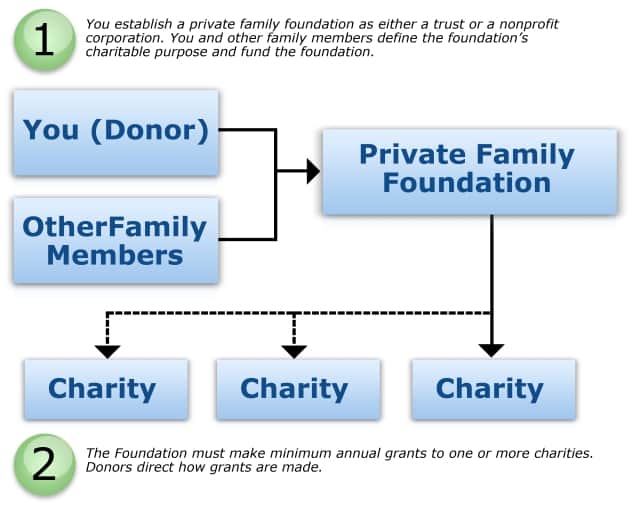

Defined for tax purposes, a private family foundation is a charitable organization that is not a public charity. It is a separate legal entity, organized as a nonprofit corporation or a trust, created by a single individual or family (donors). Private family foundations do not receive donations from the public, but are funded by family members and related persons or entities only.

A private family foundation’s primary purpose is to make grants to charities, and usually does not engage in charitable services itself (those that do are called private operating foundations). Because of its charitable purpose, the foundation is given the same tax-exempt status as Section 501(c)(3) public charities. Donors receive an immediate income tax deduction in the year they contribute property to the foundation (subject to the usual limitations), avoid capital gains tax on contributions of appreciated property, and reduce their taxable estates. The foundation, however, must pay excise tax on net investment income.

The main advantage of a private family foundation is that the donors control how contributions are invested, and how grants to charities are made. Typically, grants are directed to the donor’s community or areas of interest (e.g., medical research, conservation).

Though a private family foundation can provide great personal satisfaction and tax benefits, there is a significant downside. Foundations must be organized and operated according to specific sections of the Internal Revenue Code, follow special rules and requirements, and maintain many administrative functions. Violations can result in taxes and harsh penalties against the foundation, its donors, and others.

Getting Started

Setting up a private family foundation is complex and the assistance of an attorney is essential right from the start. The assistance of a tax professional experienced in handling nonprofit tax matters, and other consultants, managers, and staff members may also be required.

Developing Mission and Guidelines

The donors must clearly define the foundation’s charitable purpose, which typically reflects the donors’ values. A mission statement and guidelines for making grants should be published. This will help direct the foundation’s activities and inform the public about the foundation.

Formalizing

The foundation can be set up as a trust or a nonprofit corporation. A corporation requires more paperwork and formalities but can provide greater personal liability protection to the donors.

If a corporation is created, a board of directors is required and officers must be elected to carry out the foundation’s activities. Articles of incorporation and bylaws must be filed with the IRS and the state in which the foundation will operate. If a trust is created, a trust agreement must be executed and trustees must be named. Typically, board members and officers, or trustees, are family members but non-family members and professionals can also serve.

Caution: The foundation’s charitable purpose is generally set forth in its charter or trust agreement. As a trust agreement is more difficult to change, donors who want flexibility regarding the foundation’s charitable purpose should choose the corporate form.

Obtaining Tax-Exempt Status

To obtain tax-exempt status, Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code must be filed with the IRS.

The foundation may also have to apply for tax-exempt status from state income, sales, and property taxes.

Funding

Though there is no legal requirement, a rule of thumb suggests that donors contribute enough capital to generate a minimum of $25,000 annually for grants. The types of property contributed will determine the allowable tax deductions (discussed further below).

Funding can be made all at once (endowing), over a period of time, or annually.

Caution: The foundation may not hold more than 20% of the voting stock of any private or public corporation. Failure to comply will result in an excise tax equal to 10% of such total business holdings, which will increase to 200% if the excess holdings are not disposed of promptly. If a third party, other than the foundation and its disqualified persons (explained further below), controls the business enterprise, then the percentage of permissible ownership is increased from 20% to 35%.

Investing

The foundation must invest contributions in a prudent manner, and should not, for example, invest in highly speculative securities or futures. The IRS levies a 10% tax on the foundation and a 10% tax on a foundation manager for any investment that jeopardizes the foundation’s charitable purpose if there is a failure to exercise ordinary business care and prudence under the facts and circumstances prevailing at the time of the investment. If the problem is not promptly corrected, an additional 25% tax is imposed on the foundation and an additional 5% tax on the foundation manager.

The IRS levies a tax equal to 2% of a private family foundation’s net investment income, including interest, dividends, capital gains, rents and royalties, reduced by applicable expenses. The tax may be reduced to 1% if the foundation spends enough of its resources for charitable purposes. Quarterly estimated tax payments must be made by the foundation if this tax equals or exceeds $500 a year.

Making Grants

The foundation must make annual distributions in an amount equal to 5% of the foundation’s net assets that are not used to operate the foundation.

Grants can be made to a single charity or various charities according to the foundation’s express purpose, and the foundation can seek applications for grants or simply channel grants to appropriate recipients.

Grants to individuals must be made in an objective and nondiscriminatory basis according to procedures that have been preapproved by the IRS.

Caution: Failure to distribute the 5% minimum amount will result in a tax of 30% of that amount. After the initial tax is imposed, the penalty will increase to 100% of the undistributed amount if the error is not corrected promptly.

Recordkeeping, Reporting, and Public Disclosure

The foundation should maintain separate bank accounts, books, and records, including minutes of board of directors meetings, and must otherwise respect the foundation’s legal form.

The foundation may be required to file normal payroll tax withholding and reporting forms if it has employees and pays wages.

The foundation must file a federal income tax return, Form 990PF, annually with the IRS. The foundation may also be required to file a copy of Form 990PF, and/or other reports with the state.

The foundation must also provide copies of Form 990PF to anyone who requests them, and other forms of disclosure may be required.

Self-Dealing

Self-dealing is strictly prohibited. Acts of self-dealing include any transactions, such as selling, exchanging, or leasing property, between the foundation and substantial contributors or other disqualified persons.

Disqualified persons include the donors, foundation managers, owners of more than 20% of a corporation, trust, or partnership that is a substantial contributor, and certain government officials. The foundation also cannot deal with any corporation, trust, or partnership in which a disqualified person owns an interest of 35% or more.

Other types of self-dealing transactions include lending money and extending credit. Certain transactions are exempt from the self-dealing rules such as the payment of reasonable compensation and reimbursement of reasonable expenses to foundation managers and directors.

Acts of self-dealing are heavily taxed and penalized. A tax of 10% of the amount of the transaction involved is imposed on the disqualified person and a tax of 5% of the amount of the transaction is imposed on the foundation manager involved. Once the tax is imposed, if the transaction is not quickly corrected, additional penalty taxes at the rate of 200% are imposed on the disqualified person and 50% on the foundation manager. Continued non-compliance could result in loss of the foundation’s exempt status.

Other Prohibitions

Private family foundations are prohibited from lobbying or attempting to influence legislation, or attempting to influence the outcome of an election.

Private foundations may also incur penalties for expenditures that do not further the foundation’s charitable purposes.

Income Taxes

A donor can generally take an immediate income tax deduction for contributions of money or property to a private family foundation if the donor itemizes deductions on his or her federal income tax return. The amount of the deduction depends on several factors, including the amount of the contribution, the type of property donated, the donor’s basis in the property, and the donor’s AGI. Generally, for contributions of cash and non-appreciated property, deductions are limited to 30% of the donor’s AGI. If the donor makes a gift of tangible personal property or long-term capital gain property, the deduction is limited to 20% of the donor’s AGI. Any amount that cannot be deducted in the current year can be carried over and deducted for up to five succeeding years.

Caution: Donations of tangible personal property (not related to the charitable purpose of the foundation) or appreciated property (except stock and mutual funds that do not exceed 10% of a corporation’s outstanding stock) allow the donor a deduction of basis only, not fair market value.

Gift and Estate Taxes

There are no federal gift tax consequences because of the charitable gift tax deduction, and federal estate tax liability is minimized with every contribution since donated assets are removed from the donor’s taxable estate.

Suitable Clients

- High-net-worth individuals who can make contributions that are large enough to justify the costs

- Individuals who want to leave long-term legacies and/or achieve influence or stature in their communities or charitable organizations

- Individuals who want maximum control over their charitable dollars and do not need maximum tax deductibility

- Individuals who want to be actively involved in the ongoing operations of their charitable plan

- Individuals who want family members to be involved in a charitable plan

- Individuals with highly appreciated assets

Example

Harry and Wilma met and married in the 1960’s. During that decade, Harry and Wilma were actively involved in many causes, especially those related to saving the environment. Together, they created and patented a bag that is as strong as plastic but breaks down quickly like paper. What began as a small operation in their basement has, over time, turned into an enormously successful multinational company. Today, Harry, Wilma, and their children run the company, which generates millions of dollars in revenue each year.

Harry and Wilma are grateful they were able to make the world a better place in which to live, and also provide well for themselves and their family, but they want to do more. Their children can now run the company on their own, and are even grooming Harry and Wilma’s grandchildren to take over one day.

Harry and Wilma decide to step away from company business and devote themselves to some of the causes they cared about so much years ago. They found the HW Family Foundation, a nonprofit corporation that will seek, through grantmaking, to support and enhance conservation efforts around the world. They file for and receive tax-exempt status from the IRS and their state. Harry and Wilma contribute $5 million in cash to the foundation. They name themselves and their children as directors and officers of the foundation, and together will be paid salaries that total $55,000 annually. The initial endowment is invested to yield 5.5% annually in revenue, or $275,000. Salaries, taxes, and other expenses total $93,700. The foundation makes grants of approximately $181,300 each year. Annual expenses and grants equal revenues, so the foundation’s endowment does not grow or diminish.

Advantages

- Personal satisfaction of giving

- Can help cement family ties

- Donors and family members control investments and grants

- Can identify and preserve family name far into the future

- Donors may receive immediate income tax deductions

- Can reduce or eliminate capital gains, gift, and estate taxes

- Can provide continuing employment and activity to donors and family members

Disadvantages

- Upfront legal fees can be substantial

- 2% annual excise tax imposed on net investment income

- Lower deductions allowed than for other charitable donations

- Mandatory annual 5% payout requirement

- Rigorous reporting requirements

- IRS imposed limitations (e.g., self-dealing, excess business holdings)

- Taxes and penalties for violations of IRS limitations, even if inadvertent, can be severe

- Public disclosure required

If you have questions or need assistance, contact the Experts at Henssler Financial:

- Experts Request Form

- Email: experts@henssler.com

- Phone: 770-429-9166