Go out into your yard and dig a big hole. Every month, throw $50 into it, but don’t take any money out until you’re ready to buy a house, send your child to college, or retire. It sounds a little crazy, doesn’t it? But that’s what investing without setting clear-cut goals is like. If you’re lucky, you may end up with enough money to meet your needs, but you have no way to know for sure.

How do you set investment goals?

Setting investment goals means defining your dreams for the future. When you’re setting goals, it’s best to be as specific as possible. For instance, you know you want to retire, but when? You know you want to send your child to college, but to an Ivy League school or to the local community college? Writing down and prioritizing your investment goals is an important first step toward developing an investment plan.

What is your time horizon?

Your investment time horizon is the number of years you have to invest toward a specific goal. Each investment goal you set will have a different time horizon. For example, some of your investment goals will be long term (e.g., you have more than 15 years to plan), some will be short term (e.g., you have 5 years or less to plan), and some will be intermediate (e.g., you have between 5 and 15 years to plan). Establishing time horizons can help you determine how aggressively you may need to invest to accumulate the amount needed to meet your goals.

How much will you need to invest?

Although you can invest a lump sum of cash, systematic investing on a regular basis is another way to build wealth over time. Dollar-cost averaging does not ensure a profit or prevent a loss. Such plans involve continuous investments in securities regardless of fluctuating prices. You should consider your financial ability to continue making purchases during periods of low and high price levels.

Start by determining how much you’ll need to set aside monthly or annually to meet each goal. Although you’ll want to invest as much as possible, choose a realistic amount that takes into account your other financial obligations so that you can easily stick with your plan. But always be on the lookout for opportunities to increase the amount you’re investing, such as participating in an automatic investment program that boosts your contribution by a certain percentage each year, or by dedicating a portion of every raise, bonus, cash gift, or tax refund you receive toward your investment objectives.

Which investments should you choose?

Regardless of your financial goals, you’ll need to decide how to best allocate your investment dollars. One important consideration is your tolerance for risk. All investments involve some risk, but some involve more than others. How well can you handle market ups and downs? Are you willing to accept a higher degree of risk in exchange for the opportunity to earn a higher rate of return?

Whether you’re investing for retirement, college, or another financial goal, your overall objective is to maximize returns without taking on more risk than you can bear. But no matter what level of risk you’re comfortable with, make sure to choose investments that are consistent with your goals and time horizon. A financial professional can help you construct a diversified investment portfolio that takes these factors into account.

Investing for retirement

After a hard day at the office, do you ask yourself, “Is it time to retire yet?” Retirement may seem a long way off, but it’s never too early to start planning, especially if you want retirement to be the good life you imagine.

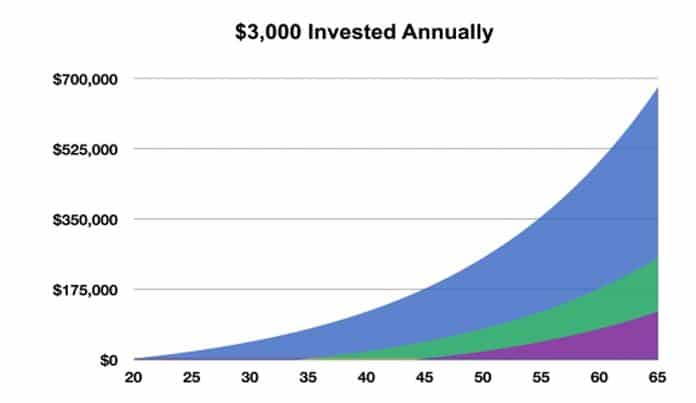

For example, let’s say that your goal is to retire at age 65. At age 20 you begin contributing $3,000 per year to your tax-deferred 401(k) account. If your investment earns 6% per year, compounded annually, you’ll have approximately $679,000 in your investment account when you retire.

But what would happen if you left things to chance instead? Let’s say that you’re not really worried about retirement, so you wait until you’re 35 to begin investing. Assuming you contributed the same amount to your 401(k) and the rate of return on your investment dollars was the same, you would end up with approximately $254,400. And as this chart illustrates, if you were to wait until age 45 to begin investing for retirement, you would end up with only about $120,000 by the time you retire.

This hypothetical example of mathematical principles is not intended to reflect the actual performance of any investment. Taxes and investment fees are not considered and would reduce the performance shown if they were included. Actual results will vary.

Investing for college

Perhaps you faced the truth the day your child was born, or maybe it hit you when your child started first grade: You have only so much time to save for college. In fact, for many people, saving for college is an intermediate-term goal — for example, if you start saving when your child is in elementary school, you’ll have about 10 to 15 years to build your college fund.

Of course, the earlier you start, the better. The more time you have before you need the money, the greater chance you have to build a substantial college fund due to compounding. With a longer investment time frame and a tolerance for some risk, you might also be willing to put some of your money into investments that offer the potential for growth.

Investing for a major purchase

At some point, you’ll probably want to buy a home, a car, or even that vacation home you’ve always wanted. Although they’re hardly impulse items, large purchases are usually not something for which you plan far in advance; one to five years is a common time frame.

Because you don’t have much time to invest, you’ll have to budget your investment dollars wisely. Rather than choosing growth investments, you may want to put your money into less volatile, highly liquid investments that have some potential for growth but offer you quick and easy access to your money should you need it.

Review and revise

Over time, you may need to update your investment strategy. Get in the habit of checking your portfolio at least once a year — more frequently if the market is particularly volatile or when there have been significant changes in your life. You may need to rebalance your portfolio to bring it back in line with your investment goals and risk tolerance. If you need assistance, a financial professional can help.

| Investment goal and time horizon | At 4%, you would need to invest | At 8%, you would need to invest | At 12%, you would need to invest |

|---|---|---|---|

| Have $10,000 for down payment on home: 5 years | $151 per month | $136 per month | $123 per month |

| Have $50,000 in college fund: 10 years | $340 per month | $276 per month | $223 per month |

| Have $250,000 in retirement fund: 20 years | $685 per month | $437 per month | $272 per month |

| Table assumes 3% annual inflation and that the return is compounded annually; taxes and investment fees are not considered and would reduce the performance shown if they were included. Actual results will vary. Also, rates of return will vary over time, particularly for long-term investments, which could affect the amounts you would need to invest. This hypothetical example of mathematical principles is not intended to reflect the actual performance of any investment. | |||

If you have questions or need assistance, contact the Experts at Henssler Financial:

- Experts Request Form

- Email: experts@henssler.com

- Phone: 770-429-9166